social security tax limit 2022

Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. The tax rates.

Budget 2022 Provision Of Social Security For Income Tax Assessees Need Of Hour In 2022 Income Tax Social Security Income

Thus an individual with wages equal to or larger than 147000.

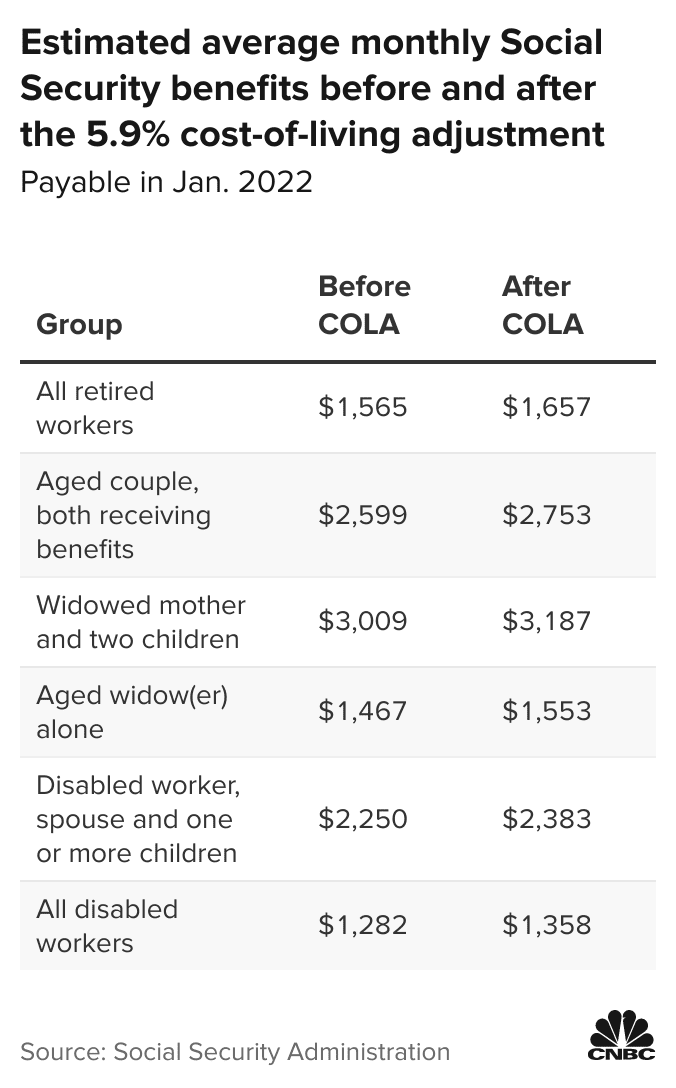

. The OASDI Social Securitys Old-Age Survivors and Disability Insurance tax rate for the wages paid in 2022 has. 2 days agoThe 2022 COLA of 59 percent increased the average retirement benefit by 92 a month. The 2022 limit for joint filers is 32000.

Or Publication 51 for agricultural employers. But the amount has been increased to 147000 for 2022. In 2021 payments grew by an average of 20 a month on the back of a 13 percent adjustment.

There is a maximum amount out of a persons pay that can be taxed by Social Security. Wage Base Limits. The OASDI tax rate for wages in 2022 is 62 each for employers and employees.

What is the income limit for paying taxes on Social Security. There is no limit on the amount of earnings subject to Medicare hospital insurance tax. New Bill Could Give Seniors an Extra 2400 a Year.

That number goes up to 65 in 2021 before the. The 62 OASDI tax which funds various Social Security programs applies only to the first 147000 of a workers earnings for 2022. The Medicare tax rate applies to all taxable wages and remains at 145 percent with the exception of an additional Medicare tax.

For 2022 the Social Security earnings limit is 19560. The federal government changes this limit aka taxable maximum every year according to the average wage index. The new Social Security tax limit in 2022.

But this number is also tied to changes in inflation and is. Ad Learn About 2021 Traditional Contribution Limits. Only the social security tax has a wage base limit.

1957 - 666 mos. However if youre married and file separately youll likely have to pay taxes on your Social Security income. That means an employee earning 147000 or more would pay a.

For earnings in 2022 this base is 147000. For the period between January 1 and the month you attain full retirement age the income limit increases to 51960. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021.

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. 1510 6040 for four Full Retirement Age by Year of Birth. Hospital Insurance HI also called Medicare Part ANo limit Federal Tax Rate1 Max OASDI Max HI Earnings Required for a Quarter of Coverage in 2022.

We Go Further Today To Help You Retire Tomorrow. Adding another 5500 for a total Roth conversion of 13500 brings Deb up to the top of the 10 income tax bracket. We call this annual limit the contribution and benefit base.

A rise in Medicare Part B premiums in 2023 would offset a portion of the COLA increase for Social Security recipients who have Medicare premiums deducted directly from. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security. When you file your tax return the following year you can claim a refund from the IRS for Social Security taxes withheld that exceeded the maximum amount.

How to Calculate Your Social Security Income Taxes. Refer to Whats New in Publication 15 for the current wage limit for social security wages. 9 rows This amount is known as the maximum taxable earnings and changes each year.

If a couple is married each person would have a 147000 limit. The maximum amount of earnings subject to the Social Security tax taxable maximum will increase to 147000. Maximum Taxable Earnings Each Year.

Given these factors the maximum amount an employee and employer would have to pay is 9114 each 18228 for self-employed. MORE FROM FORBES ADVISOR Best Tax Software Of 2022. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level.

The OASDI tax rate for wages in 2022 is 62 each for employers and employees. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is 9114 62 percent of. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each.

The Social Security tax rate remains at 62 percent. Also as of January 2013 individuals with earned income of more than in Medicare taxes. Unlike many other tax cap limits this stands as an individual limit.

The resulting maximum Social Security tax for 2022 is 911400. IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived. For earnings in 2022 this base is 147000.

The 765 tax rate is the combined rate for Social Security and Medicare. If that total is more than 32000 then part of their Social Security may be taxable. If your Social Security income is taxable the amount you pay will depend on your total combined retirement income.

Its a phased approach. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below. This means high earning people will not have to pay taxes past a certain point in their income.

For their 2020 state tax returns West Virginia taxpayers can shield 35 of Social Security benefits from taxable income. 1942 - 6510 mos. Indeed this will definitely hold for anyone over 60 who earns more than Social Securitys maximum taxable amount currently 147000.

Open A Traditional IRA Today. The Medicare portion HI is 145 on all earnings. For every 2 you exceed that limit 1 will be withheld in benefits.

That means an employee earning 147000 or more. Filing single head of household or qualifying widow or widower with 25000 to 34000 income. This amount is also commonly referred to as the taxable maximum.

New Bill Could Give Seniors an Extra 2400 a Year. As of 2021 the maximum earnings subject to social security taxes was 142800. However you will.

The wage base limit is the maximum wage thats subject to the tax for that year. Fifty percent of a taxpayers benefits may be taxable if they are. SSAgov also reports that there is no taxable maximum for Medicares Hospital Insurance HI program in 2022.

We deduct 1 from benefits for. Read more about the Social Security Cost-of-Living adjustment for 2022. The tax rates for HI funding are 145 each for employees and employers and 29 for self-employed people or independent contractors.

The Social Security limit is 147000 for 2022 meaning any income you make over 147000 will not be subject to social security tax. In 2022 that limit is. If a couple is married each person would have a 147000 limit.

The exception to this dollar limit is in the calendar year that you will reach full retirement age. 1938 - 652 mos. The earnings limit for workers who are younger than full retirement age see Full Retirement Age Chart will increase to 19560.

Updated April 2022 1 2022 Social SecuritySSIMedicare Information.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Both Centre And State Government In 2022 State Government Government Social Security Benefits

How Can I Figure Out My Payroll Taxes In 2022 Payroll Taxes Payroll Tax

Do You Have To Pay Tax On Your Social Security Benefits Youtube

Rental Property Roi And Cap Rate Calculator And Comparison Spreadsheet Template Income Property Analysis For Real Estate Digital Download

All The States That Don T Tax Social Security Gobankingrates

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Social Security Wage Base Increases To 142 800 For 2021

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

4 Social Security Changes To Expect In 2023 The Motley Fool

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time